If in case Va Money – Who’ll imagine Virtual assistant mortgage

Va mortgage presumptions can happen to have a purchaser and a provider who can work-out an accept each other therefore the consumer can also be meet the requirements on most recent financial.

Which have interest levels large and you will people which have a set number of money monthly they want to spend out-of pouch due to their mortgage payment an interest rate that’s 3% more than it was last year is now able to limit the price particular customers may take to your.

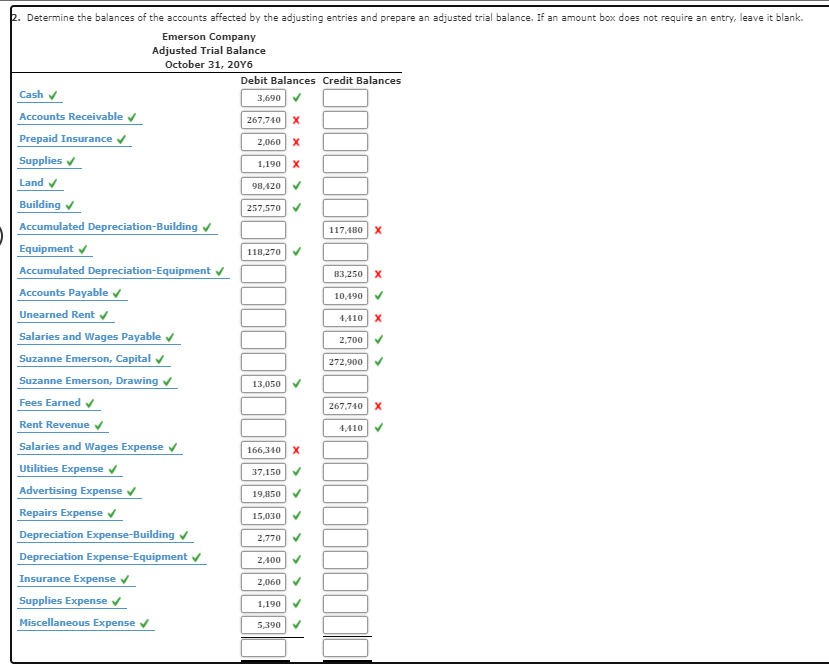

Such, I go aside and acquire somebody who bought their home a couple years ago to have $350K and they today are obligated to pay $335K. If the supplier and i also you will definitely come up with a package, We qualify into the most recent bank and purchase the house that have $15K from my wallet into the vendor, the difference inside the percentage could well be nice whether they have payday loan Henagar a beneficial 2.25% and i also is also currently qualify for good six.2%.

Very why don’t we go one step further of these around one to say “well then I must lay $15K off my very own pocket”.

The fantastic thing about the assumption is new funding percentage is quicker to help you .5% of your own financing and that means you save thousands of dollars are extra for the mortgage depending on should this be the first have fun with of one’s Va mortgage or additional entry to the Virtual assistant financing and you also ensure you get your $15K into savings along the weeks. The fresh recapture time for $15K during the a discount away from $971 30 days is actually all in all,:

15,000 / 971 / 12= 12 months and 3 months! Fundamentally in one single year and you can three months you currently build your 15K straight back in the savings you will see from the of course the newest financing. More