Mortgage Cost Diving Back up to the Rising prices News

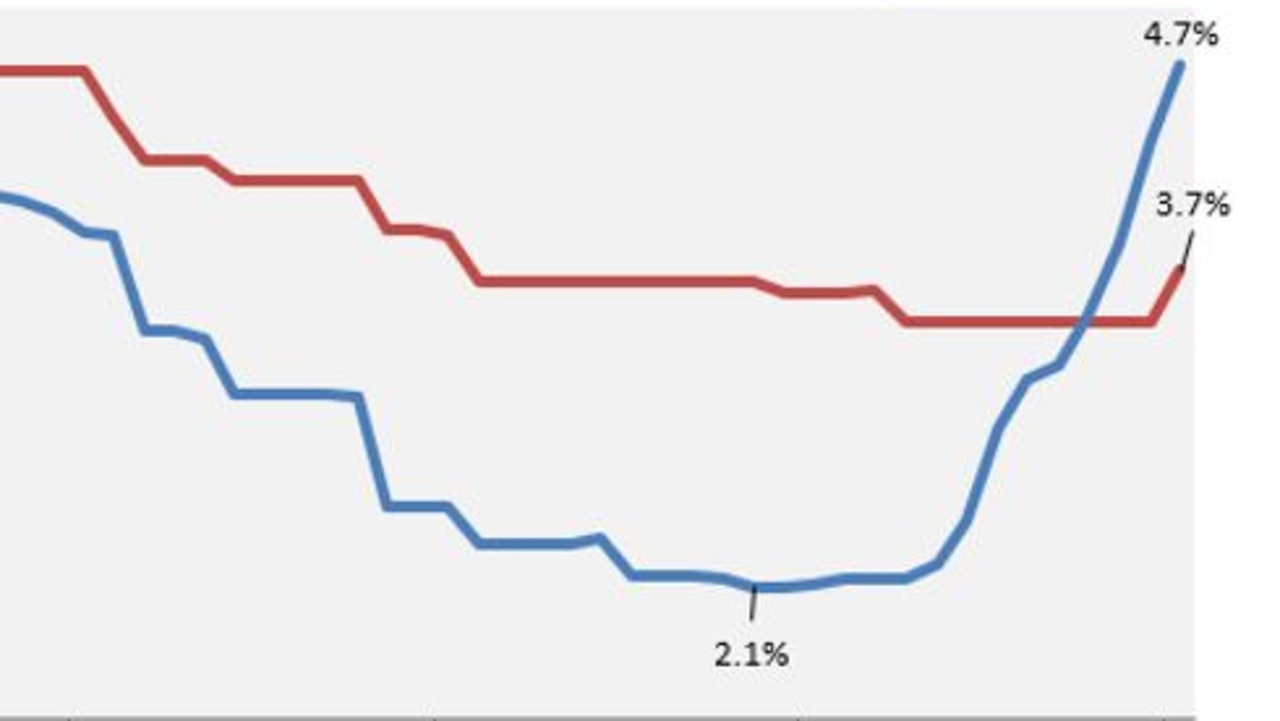

Caused by undesirable rising prices investigation put-out last night early morning, 30-12 months financial prices grabbed a huge action high Thursday. Climbing more than a 10th out-of a percentage part, the 31-12 months average is back around seven.60%. Averages getting pretty much all financial products popped-many of them of the double-little finger base points.

National averages of the lowest rates provided by more 2 hundred of the country’s top lenders, having a loan-to-worth proportion (LTV) out-of 80%, a candidate which have an effective FICO credit score regarding 700760, no home loan products.

Because costs vary commonly across loan providers, it’s always wise to comparison shop to suit your best home loan option and you can contrast cost frequently no matter the form of home loan your seek.

The current Home loan Rate Averages: The fresh Get

Shortly after a moderate three-time dip, pricing on 30-seasons mortgages shot up 11 foundation facts Thursday, answering for the inflation news. You to definitely forces brand new leading mediocre back up so you’re able to 7.60%-just a few affairs shy of past week’s 7.65% understanding you to definitely designated the fresh new average’s most costly peak just like the November.

Thirty-seasons prices was significantly elevated compared to. early March, if the mediocre dipped the toe-in 6% region. However, rates are still most less expensive than Oct, in the event that 31-year average hit a historical 23-seasons peak out of 8.45%.

The brand new buy 15-season mortgage cost extra 15 base circumstances Thursday. Brand new fifteen-12 months average recently strike its most costly top much more than simply five days, in the 7.00%, features repeated you to. More