Methodology: Exactly how Did We Select the right Virtual assistant Lenders?

Something else In my opinion regarding try credit debt

“The most popular government financing which is available everywhere to help you everyone is the FHA mortgage. There’s several reason anybody do fit into FHA as opposed to old-fashioned that. The borrowing is a little to the crummy side, what if lower than 700. You can aquire antique which have as a result of an effective 620 rating, however the financial insurance coverage becomes very costly. FHA does not discriminate – regardless of how finest or bad your credit was, the mortgage insurance is an identical.”

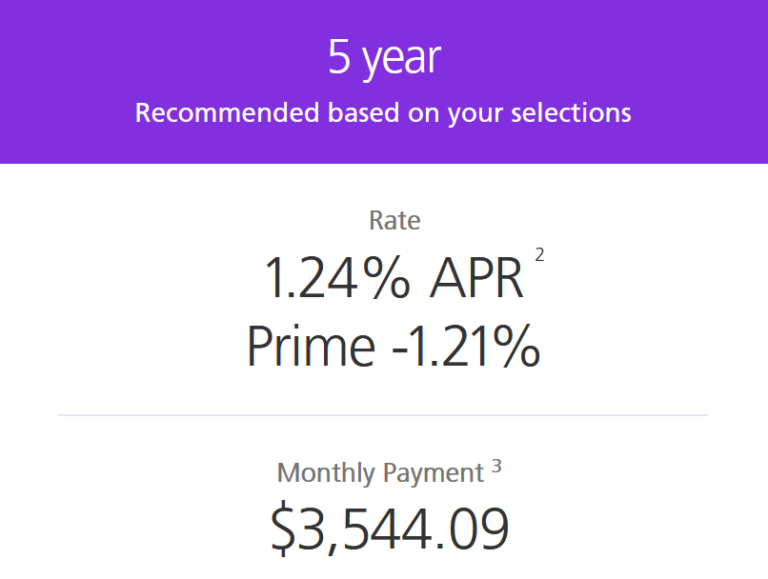

“The new processed answer is to just go with a low price. But not, you want to be the cause of having going to suffice your loan ideal. Was repayments likely to be easy for your? That is most likely in order to help you in the event that simply take aside an effective HELOC or refinance later on, in the place of someone who may have a lot more of a-one-away from type of?

“They could have the lowest costs to give you involved, however they possess most, hardly any hands holding after the fact. We won’t recommend purchasing an exorbitant matter much more to have possible features down the road, but just you should never constantly fundamentally go with the fresh new material-bottom lowest price. There is certainly often an installment thereupon.”

As i wanted a home, I became in a position to text my loan administrator (whom my real estate agent demanded) and get small reactions once i had concerns or needed an enthusiastic up-to-date preapproval page to have a deal

“Understand that you’re not only choosing a home loan company – you will be together with strengthening a homebuying team. So you’re able to snag our home you would like within competitive market, need a loan provider which can disperse quickly and has a communication to you and your agent. More