Kaiser Base Medical facilities ‘s the Kaiser Permanente entity that serves as financial towards Kaiser Permanente CRNA Education loan Program

Kaiser Basis Healthcare facilities partners having Scholarship America, Saint Peter, MN which serves as an agent to greatly help with: (1) online loan application processes, (2) college or university browsing confirmation procedure, (3) shipments out of mortgage checks. Kaiser Base Healthcare facilities does not charge broker costs to help you its consumers. Fund are available by Kaiser Basis Hospitals pursuant so you can California Money Legislation licenses.

Kaiser Permanente announces that loan program to help this new and ongoing pupils in the Samuel Merritt College Program from Nursing assistant Anesthesia. These guidelines define CRNA finance designed for new graduating classes from 2026 and 2027.

Fund regarding $ten,000 annually are available to students regarding Samuel Merritt College or university System of Nurse Anesthesia so you can a max loan amount out of $20,000 more than 2 yrs. Economic require is perhaps not a traditional for mortgage acceptance. Money could be forgiven using qualifying employment which have Kaiser Permanente inside Northern California to possess a maximum of $5,000 forgiven annually away from a career.

Carefully Take a look at webpages content having full info on loan quantity, eligibility requirements, relevant due date dates and you may Mortgage Disclosure Information.

The program is loans Northport AL applied of the Scholarship The usa, the country’s largest creator and director out-of grants or other studies service apps having corporations, foundations, connectivity, and individuals. Eligibility to possess private applications is set at just discernment of the new recruit, and qualified applications was reviewed by Grant America’s review people. Money is actually offered to help you qualified recipients versus reference to creed, faith, sexual positioning, age, impairment, or federal provider.

Candidates on 2024 prize period must be acknowledged towards the or enrolled in the fresh Samuel Merritt School Program off Nurse Anesthesia and you may expect to scholar from the qualifications readers need certainly to

- end up being signed up complete-amount of time in the program out of Nursing assistant Anesthesia

- care for high enough educational and you may scientific improvements centered on Samuel Merritt School System conditions

- manage about good step 3.00 GPA to have nurse anesthesia system coursework

- be a great U.S. resident. Student visas otherwise temporary A career Authorizations are not acknowledged (candidates should be eligible for employment)

Samuel Merritt School was called to ensure for every applicant’s qualifications for this loan prize disbursement. Samuel Merritt cannot make certain an applicant will have a beneficial loan. Individuals might possibly be notified in .

Mortgage Shipments Towards the 2024-twenty five prize year, fund was disbursed In two repayments away from $5,000. Loan inspections might possibly be made payable to your recipient and you will sent on their street address .

- There’s absolutely no guarantee that readers gets loan consider(s) with time to expend tuition.

- Readers that do not take care of the minimal GPA, an effective status, and/or complete-big date enrollment loses qualifications for all the future disbursements.

Qualified recipients just who properly complete the 2024-25 instructional season is enjoy to keep its CRNA College student Financing financial support to pay for university fees in 2025-twenty six

Recipients must work in the new expertise whereby it obtained the financing in order to secure forgiveness and should receive a job in the Kaiser Permanente in this 6 months of the graduation date otherwise financing forgiveness usually do not occur.

Most of the mortgage readers are encouraged to submit an application for being qualified positions pursuing the graduation, yet not, Kaiser Permanente will not provide liking to help you loan readers in the employing techniques. Every people having employment, also latest otherwise prior professionals away from Kaiser Permanente, is susceptible to regular hiring methods and may satisfy all of the qualifications conditions place because of the Kaiser Permanente, also a physical examination and you will a criminal record check.

Individuals cannot trust the potential for mortgage forgiveness for the deciding whether they should be able to see mortgage installment financial obligation. Users who neglect to manage sufficient instructional advances, that do maybe not receive a being qualified condition, otherwise do not be eligible for financing forgiveness need repay the fresh financing within the terminology established about loan arrangement That it boasts a half a dozen-month appeal-100 % free sophistication several months adopting the graduation and you may a 10 percent (10%) rate of interest after that. The mortgage can be prepaid service rather than punishment.

Loan Forgiveness otherwise Cost Loans could be forgiven because of qualifying a job that have Kaiser Permanente contained in this Northern California for approximately an optimum level of $5,000 a-year out-of a position

Changes Kaiser Permanente supplies the authority to feedback new conditions and you may procedures associated with the financial aid system and also to make modifications at any moment and termination of your own system.

Submission of your software doesn’t make-up an entitlement otherwise an excellent legally-enforceable directly to a loan. From the distribution the application form, the brand new applicant agrees to simply accept the brand new erica and you can Kaiser Permanente just like the final. Such behavior do not offer the right regarding attention. Mortgage candidates have to fill out the application form from the penned work deadlines. Grant The usa and Kaiser Permanente capture zero obligation and grant zero conditions to own errors for the birth or low delivery of the postal service.

Tax Implications Experts recommend mortgage readers consult a taxation advisor to go over the brand new taxation ramifications out-of one another mortgage fees and you will forgiveness. For example, the Irs currently takes into account financing forgiveness to be taxable income to own the season where its made. Mortgage readers have the effect of the fresh new percentage of the many particularly earnings fees, and you will Kaiser Permanente may be required to help you keep back of recipients’ payroll monitors a price adequate to protection including taxation. Additionally, brand new Internal revenue service takes into account notice repaid into student loans becoming taxation-allowable not as much as specific circumstances.

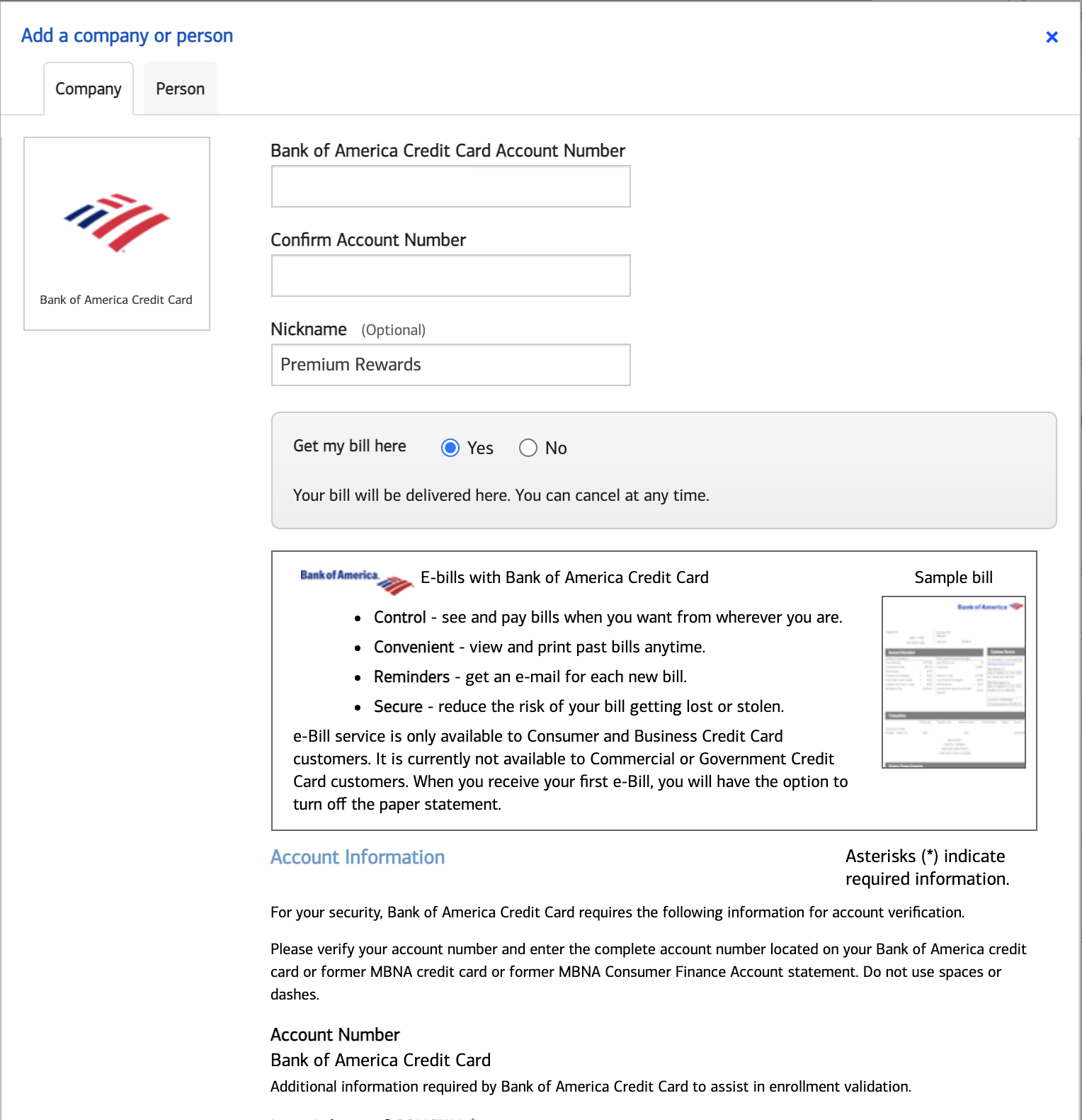

Kaiser Foundation Medical facilities have partnered having Grant America. Deciding on the switch less than tend to reroute that the latest Scholarship The united states College student Heart!