Application Put – Fund necessary for a lender just before control that loan request

Annual Mortgagor Statement – A research taken to the new mortgagor yearly. The new report suggests exactly how much is actually paid-in fees and you can attract when you look at the seasons, therefore the leftover home mortgage harmony towards the bottom of the year.

A few of the can cost you you shell out on closure is actually factored into the Apr having easy analysis. Their actual monthly obligations are based on new periodic interest, perhaps not the new Apr.

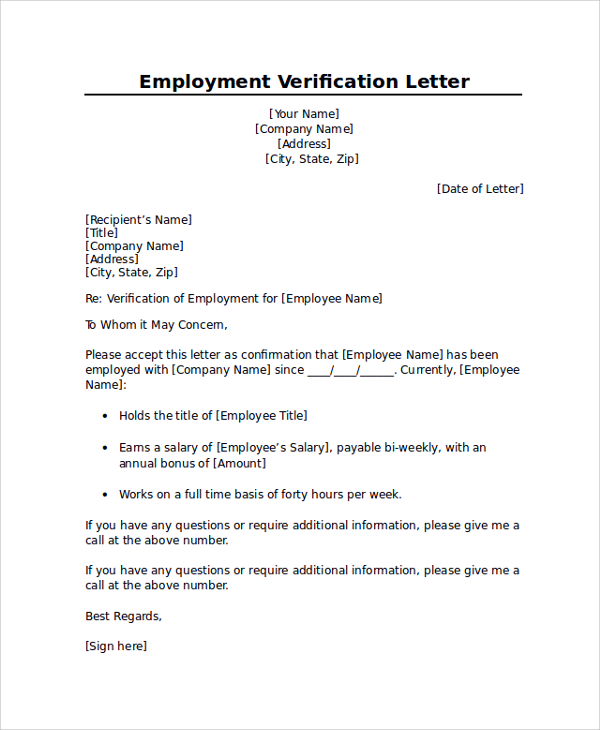

App – The process of trying to get a home loan. The expression “application” fundamentally relates to a form that is used to get financial advice of a debtor by a loan provider.

Basically in initial deposit was gathered to cover the will cost you from a keen appraisal and you may credit history and will otherwise is almost certainly not refundable.

Annual percentage rate (APR) – Making it more relaxing for people you can try this out to compare real estate loan desire cost, the government set up an elementary structure named an enthusiastic “Apr” otherwise Apr to incorporate an excellent interest to possess assessment searching objectives

Assessment Payment – So you’re able to check if the value of your house helps the loan matter you consult, an assessment will be bought because of the lender. The fresh new assessment may be performed by a professional who’s common which have home prices in your community and can even or may well not need an inside check of the home. The fee into the assessment is usually passed away toward borrower because of the financial. For our investigations purposes, the fresh new assessment fee was a 3rd party percentage.

Appraised Worth – An impression out-of good property’s reasonable market price, centered on an appraiser’s degree, sense and you can data of the house.

Love – A boost in the worth of a house because of changes inside field standards or any other causes. The alternative out of depreciation.

Assessment – The procedure of place an esteem for the assets into the rigid purpose of taxation. Can also consider a levy facing assets to have a unique mission, eg a beneficial sewer investigations.

Asset – Anything off monetary value that’s belonging to a man. Property were property, personal property, and enforceable says up against others (along with bank accounts, brings, shared financing etc).

Assumable Home loan – A loan that does not have getting paid-in complete when your residence is offered. Alternatively, the new proprietor may take over payments towards the existing loan and you will spend the money for merchant the essential difference between product sales rate and you may the bill to the loan.

Assumption Condition – A provision within the a keen assumable mortgage that allows a purchaser to assume responsibility with the mortgage on seller.

Expectation Percentage – The price paid down in order to a loan provider (usually by the purchaser of property) because of the assumption from a preexisting financial.

Attorneys Viewpoint – Commonly referred to as a “label opinion”. This fee resembles the brand new title insurance policies necessary for the brand new financial. It is a document provided by the legal counsel listing one liens or encumbrances that could change the possessions that will be an issue regarding public number. For our assessment objectives, the brand new attorney thoughts commission is recognized as being a 3rd party percentage and may be added to this new title insurance policies or closure payment by particular lenders.

The loan does not need to be paid entirely because of the the first debtor on sale or transfer of the property

Attorneys Experience – Regarding new payment/closing payment. This percentage try basic in some claims and that’s this new closure attorney’s fee having witnessing the new signing of one’s closure files. For our testing purposes, an attorney witness fee is recognized as being a third party percentage and can even be included in the brand new term insurance policies or closure payment by particular loan providers.