Half a dozen tips to buying your house, regarding in search of a loan provider to help you closure

Understand the steps of getting a home loan, of trying to find a lender to closure in your home. Can get home financing as well as how loans in Yampa the procedure functions.

For some homebuyers, home financing is important. However, the loan financing tips can be overwhelming. Is a step-by-step guide to taking home financing, regarding preapproval so you’re able to closing.

1. Find a lender.

Their homebuying journey should not start by selecting property. It has to begin by seeking a loan provider. Mortgages is actually much time-label relationships, and you will probably desire to be positive that the mortgage provider also provides an effective mix of top quality service and you may aggressive prices.

Consider the profile and you may electricity of business. In addition to, listen to closing costs and you will charge in addition to attention cost. They may be able subscribe to a high complete loan prices. Acquaint yourself very early on what will set you back might possibly be placed on their loan. Specific regular will cost you and you will fees try intricate afterwards in this article.

dos. Score preapproved.

Getting an effective preapproval could save you day after. Plus, you’re going to be when you look at the a more powerful updates and come up with a credible offer in order to a seller. Check with your bank to see if they supply preapprovals.

An effective preapproval offers a sense of extent you can manage to acquire to have a mortgage. To choose how much your qualify for, the financial institution may look at the credit history, income and you may costs. A home loan preapproval can be briefly affect your borrowing from the bank, nevertheless support their financial evaluate your capability to pay for an excellent mortgage repayment, in addition to property taxation and you may insurance policies. This step may also be helpful pick any possible issues with your own credit, to start restoring them.

When you find yourself preapproved, you’ll receive a page from your bank. This really is important to a supplier, who can view their render rates, and you can whether you have resource in position. If you find yourself dealing with an agent, they must be able to assist you in and come up with an offer.

step three. Build a deal.

Once you have discover a house you love and can afford, create a deal. Be sure to lookup price ranges away from comparable homes from the town, you understand the seller’s price tag.

Their real estate agent can prepare yourself a relative field data so you’re able to find out a reasonable offer. Its sense can be purchased in useful into the discussion procedure.

If the supplier welcomes your provide, a purchase contract could be authored. That it formalizes both parties’ intention to go through into the contract. Publish a duplicate towards lender, who’ll make suggestions through the application for the loan procedure.

4. Fill out underwriting records.

As recognized getting an interest rate the financial institution usually formally consider your data from the underwriting processes. The target is to assess your ability to repay the bucks your obtain. It indicates examining your credit score, income, property, and you may prior and you will newest debts. Required a short while to numerous months according to in case the financial gets all your valuable pointers.

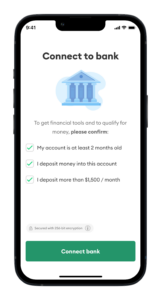

During this phase, the lender will require you to definitely send files. So you’re able to automate the process and you may help the coverage of one’s information that is personal of a lot loan providers service uploading your posts through the website otherwise mobile application. Loan providers also can enables you to grant consent to allow them to digitally access your details right from your financial institution otherwise manager. What you’re asked for may differ according to the variety of loan you’re applying for as well as your lender’s underwriting requirements. This type of data files are normally taken for such things as:

- Spend stubs for the past thirty day period.

- W-2 versions over the past 2 years.

- Factual statements about a lot of time-title expense, such as automobile and you may college loans.