You can see your state-by-condition list of USDA Loan Restrictions, that are upgraded a year

USDA money try not to actually have an important minimum credit rating, however, loan providers giving such funds generally require a credit score out of 640. Fico scores below 640 may be considered in the event the there are more appropriate credit uses that aren’t in the borrower’s credit rating however, are going to be documented as being paid off as conformed.

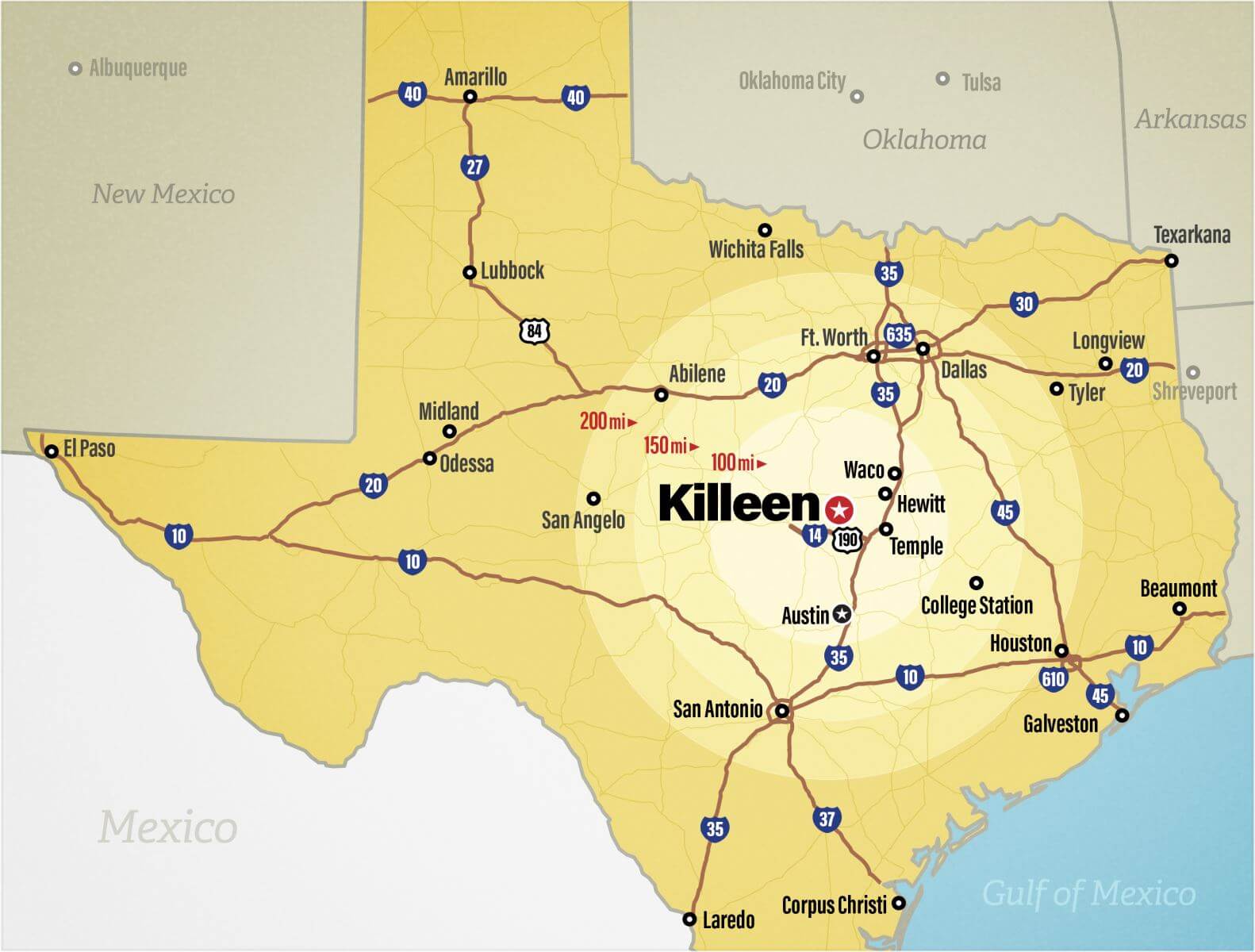

USDA talks of outlying parts amply

What is actually outlying? You’ll be shocked. The latest USDA describes “rural” generously — you don’t have to purchase a home regarding the ranch buckle in order to qualify. Indeed, most of the this new belongings urban area regarding the U.S. falls within this definition of rural. The outlying designation has many brief- to typical-sized locations and residential district portion outside large towns and cities. like it The fresh USDA even offers an excellent USDA property eligibility research tool to choose a given property’s qualifications.

not, if you don’t have a certain assets planned, but alternatively desire inside the a place or region to own a brand new home, the new unit makes you zoom within the for the a location by with the search button on your mouse, to pick breaking up outlines between eligible and non-eligible town.

Whether your property you want to pick try an an eligible rural city, it will nevertheless be susceptible to restriction mortgage limitations for this town.

Basic USDA Household Guidance and requirements

To help you qualify for this type of mortgage apps, our home should be more compact sizes, framework and cost. Small homes will depend on what is typical to possess homes into the the space and generally cannot go beyond dos,000 sqft significantly more than levels; the market price do not exceed the newest applicable area mortgage limit, plus it cannot tend to be structures principally used for income-creating intentions.

Up-to-date assets direction observe that an existing house or apartment with an in-ground share may be thought modest; however, in-soil swimming pools which have new build or having services which might be ordered new try prohibited. In past times, existing home with in-soil pools was in fact ineligible.

House constructed, bought otherwise rehabilitated need meet with the federal model strengthening code accompanied by the county and you will thermal and you may website conditions place by the USDA’s Construction and you will Neighborhood Organization Software (HCFP). Are produced construction otherwise mobile residential property have to be permanently installed and really should meet with the Company off Casing and you may Urban Development’s Are made Household Design and you will Protection Requirements together with HCFP’s thermal and you may site conditions.

USDA Guaranteed Mortgage program evaluation

The fresh Guaranteed Financing program is financed compliment of USDA-accepted lenders and you will brokers. For instance the FHA program, brand new USDA does not personally finance this type of fund alone but instead pledges all of them, making them a less dangerous investment to the lenders. These types of financing have no subsidies — you find an educated contract you can away from a lending company and you may spend the money for going speed.

The brand new Guaranteed Loan system advice allow people secure to 115 percent of one’s median income (AMI) towards urban area shortly after specific alterations. A beneficial mortgage manager just who focuses primarily on USDA or other regulators mortgages should be able to help you determine if you qualify.

You’ll be able to perform a living care about-evaluation using the USDA eligibility product; Weight the latest webpage, locate and then click towards the “Single Loved ones Homes Guaranteed”, up coming click on “Income Qualifications” and select your state and you may condition and you can fill in the newest areas as needed.

- The brand new USDA GLP claims mortgage brokers compliment of private loan providers toward purchase of modest housing into the designated rural areas.

- Money degree is up to 115 percent out-of area median income for the same size house.

- Zero down payment is needed.

- Funds is fixed-price mortgage loans with 29 year terminology.

- Finance are used for repairs and protection the brand new capital fee.