Will you need financing that is 31-year, 20-seasons, or 15-year?

Check your records very carefully for any mistakes. Guarantee that the accounts noted was your own personal and may however be on their declaration. Look for weird models of one’s identity, tackles having metropolitan areas that you don’t stayed, and you will levels appearing many times. Or no of these problems can be found in your report, disagreement all of them with the fresh revealing department. All the conflicts must be paid prior to the mortgage application goes to the newest underwriters, therefore the ultimately you begin a dispute, the better.

File Your own Fees

Mortgage brokers usually ask you for the past a couple tax returns. They would also like that sign a questionnaire which allows these to establish all the info with the Irs. So make sure you file their fees! If you would like make clear a taxation situation away from a great early in the day year, take effect on that also.

Research the Housing marketplace

In advance traveling house and you can making an application for mortgages, start pursuing the housing industry. Take a look at section you may like to get into the, and begin record this new readily available property inventory. Just what variety of residential property come? Just how much carry out they record having? How much time would it remain on the business? personal loans in Miami with bad credit Just how much create it sell for (highest or lower than checklist rates)? How much out-of a made manage refurbished belongings give over homes that are cosmetically old? Speaking of things you should understand early and make offers. You will find lots out of home applications offered that allow your to help you define certain search details and have reputation on the residential property that fit your look. Download you to definitely and commence tracking the market industry.

Learn about Mortgage loans

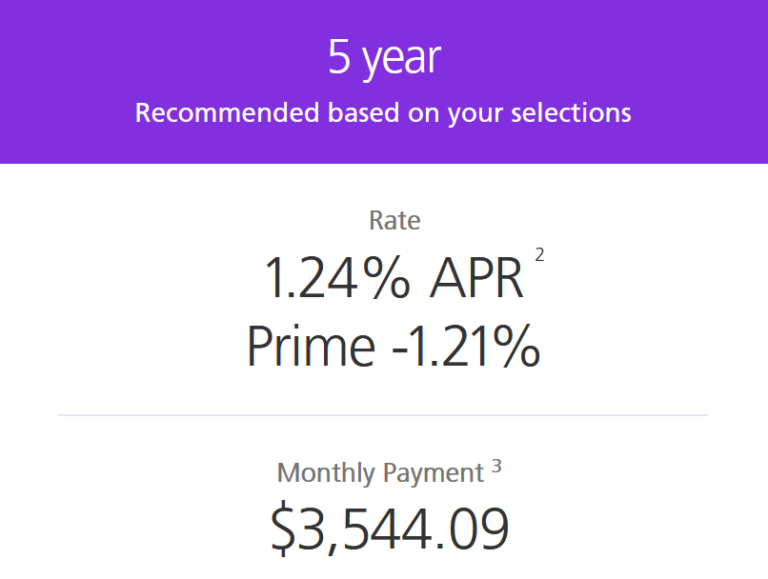

You’ll find as numerous types of mortgages as there are sizes out-of domiciles. Do you realy get a fixed otherwise varying price? Commonly the loan be federally supported or conventional? These are merely some of the inquiries might face because the you have decided just what financial most closely fits debt need. Initiate researching different type of mortgage loans, and plug particular amounts for the home financing calculator, that may leave you an idea of exactly how much each type of home loan costs monthly as well as the life span away from the borrowed funds. There are also of a lot software which will help earliest-date buyers, pros, or other groups, therefore definitely do your research.

Think about your Debt

Only a few personal debt are crappy debt. Browsing college or university otherwise change school helps you afford the home from your own ambitions, anyway, and more than Americans you want a car to work and you will would the life. Your debt load will get an impact on their financial, regardless of if. Mortgage lenders want applicants who possess shown that they can carry out loans sensibly. Your debt-to-income ratio commonly affect how big is out-of a home loan you could potentially get approved to have, very look at your faster debts. Have you got playing cards having short balances? The individuals small balance usually still have at least fee of $25 approximately thirty days, that will make sense! Knock out those individuals quick balances and you may considerably improve your debt-to-earnings ratio.

End Biggest Economic Alter

When you’re ready to apply for a mortgage, we need to lock down your financial life and have your own ducks in a row. This isn’t enough time to change efforts, buy a different car, otherwise lay a visit to Japan in your credit card. You desire your money on the really secure as you start the application processes, and you also yes wouldn’t should make one alter once you incorporate. Many people eliminate their home loan approval immediately following getting into a furniture-shopping spree before it close on the new house. Avoid being that person!