six Activities That affect Car loans interest rates

Regardless if you are finding your first auto since you merely received your vehicle operators permit, otherwise you are interested in another relatives vehicles, car loans interest rates may differ widely certainly some other users. That’s because most of the consumer features a new economic reputation. Just what stays lingering is the situations one loan providers make up whenever deciding a consumer’s mortgage. These types of half a dozen products produces a big difference into automobile financing rate you may be considering.

Circumstances That affect The car Financing Rates

When discussing car loan rates – and you will constantly discuss – it helps to know what you might be facing. Before heading to a distributor, assess this type of six things to know if your stand good risk of delivering financing and also at exactly what speed.

1. Credit rating

Many people be aware that the https://paydayloanalabama.com/millbrook/ credit history impacts whether or not they is accepted for a loan and you may affects the interest rate at which a loan is billed. Auto loans basically utilize the Fico Car Rating having a variety ranging from 290 and you may 900. Most lenders want a rating with a minimum of 700, although this doesn’t mean you’re refuted if the rating is lower.

Ashley Dull, News Movie director regarding says, Loan providers see we you would like a vehicle, hence, the fresh new recognition requirements to possess an auto loan are a lot significantly more lenient than simply state a personal bank loan. A lot of people will get funded with score as low as 500, otherwise no or minimal credit rating. Vehicles loan providers care and attention more info on your earnings and you can capacity to create the newest repayments than just your credit rating.

2. Earnings

Income is a huge determining factor whenever making an application for a loan. Having a full-time employment demonstrates that you will be able while making payments every month. not, how big is their paycheck isn’t the simply yardstick. Good salaried staff may have a less complicated time protecting that loan than just a personal-functioning people. Also, inside the mind-operating class, the chances of getting a loan are greater for these having a registered business rather than a freelancer.

step three. Length of Name

The fresh new lengthened your loan term was, the greater amount of appeal might shell out involved. Terms ranges away from 36 months to 72 months. Car finance interest levels vary but currently range from 5.07% to have a beneficial 36-few days label so you can 4.56% to possess an effective 60-week identity. Opting for a phrase relates to how much cash you can afford to blow 30 days. Whenever you pay for large installments, their title might possibly be faster in addition to overall attract paid down usually be lower.

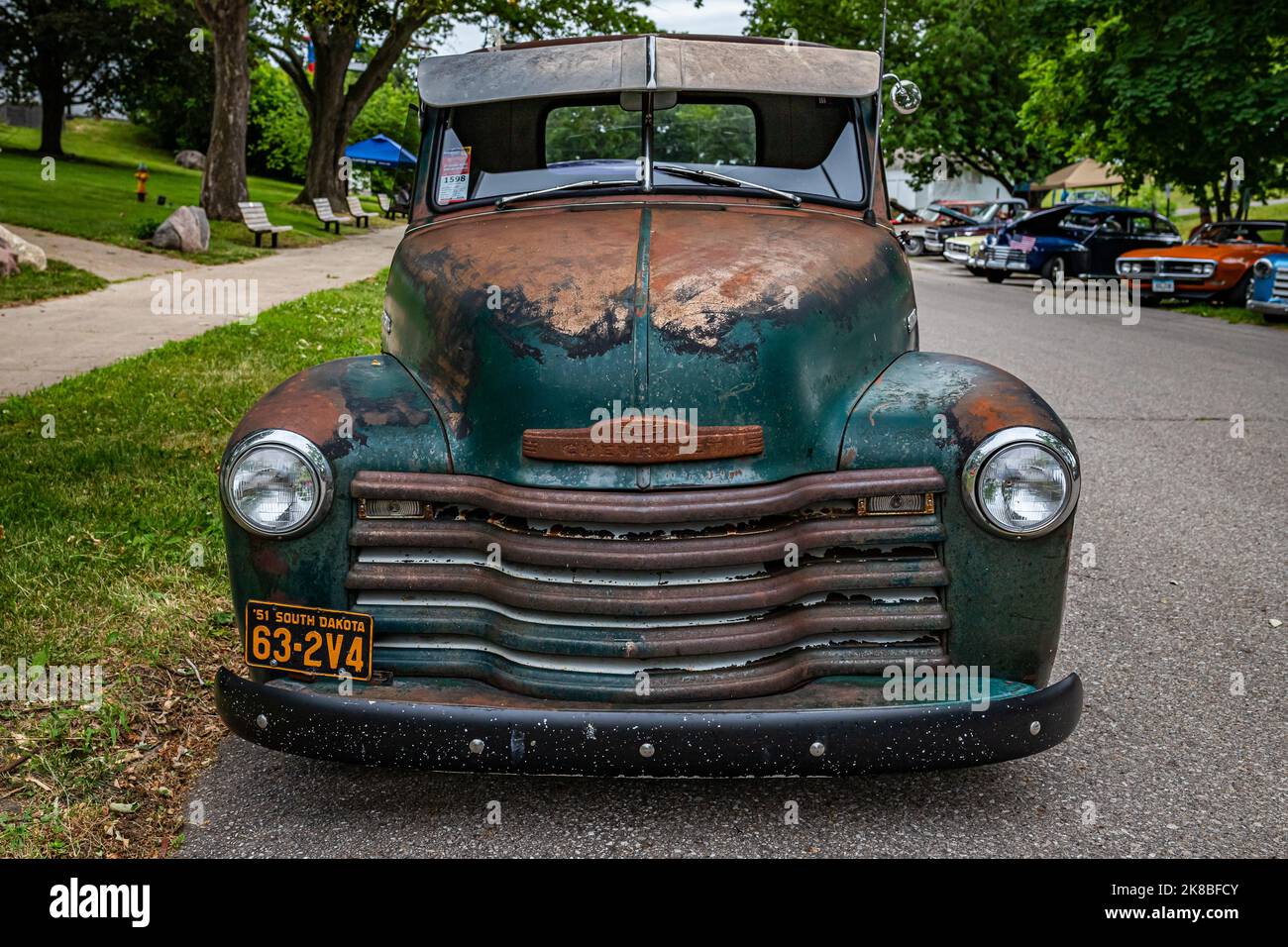

Exchange on your own dated vehicle otherwise while making a deposit decreases the loan amount plus the full interest they attracts. Trade-ins can also be lower the loan amount a bit significantly. When your most recent car have a swap-inside the property value $seven,100000 plus the automobile you happen to be to shop for can cost you $20,one hundred thousand, you’ll only need that loan out of $thirteen,100, considering that you do not are obligated to pay some thing on the trading-inside the vehicle.

Traders also are much more likely to supply funds and you may discuss costs so you’re able to people whom generate an upfront down-payment or trade-in their old vehicle. And then make a deposit might help their recognition possibility, says Humdrum. The readiness to put money down on the automobile shows the latest bank you’re seriously interested in the fresh new marketing, and they will perform what they is so you’re able to accept you.

5. Preapproval

If you’re applying for loans in the a lender or borrowing from the bank relationship and would like to test the latest seas, shoot for preapproved for a loan. Preapproval operates a silky check against your credit score to decide exacltly what the it’s likely that of being recognized for a financial loan. Additionally, it may give you a sense of the attention and you may label you be eligible for.

You can do this with quite a few loan providers to determine what you to offers the most useful rates. Moreover it offers power whenever discussing within supplier. In the event your dealer really wants your company, they could just be sure to finest the latest lender’s interest.

six. The latest Dealer’s Earnings

Whenever money due to a supplier, they will certainly include an extra fee on top of the lender’s interest. Look out for which when negotiating costs. The newest dealer would not inform you this as it’s an extra portion of funds they are to make toward marketing, but it form there is step-space to try to knock down the rate it introduce you.

Do i need to Rating a loan With Poor credit?

Delivering financing with a poor credit score is tough however, not impossible. You will find 2nd options loan providers which concentrate on helping those with less than perfect credit. You will find a catch, even if – rates of interest tend to be high because the risk for the bank is high.

Mundane means buy-here-pay-right here plenty rather of these which have really low borrowing scores. The car choice could be minimal, nevertheless they agree just about anyone who’ll prove they are able to generate new repayments. The fresh new caveat to those dealers is that they usually fees highest interest rates, while make payments bi-a week otherwise weekly in the place of monthly.

The last resort would be to decelerate buying a car until you improve your credit history. It will require just as much as 3 to 6 days of great borrowing from the bank choices just before your credit rating will show signs and symptoms of update. You may have to hold off no less than annually prior to your credit history improves in order to an even for which you commonly qualify for financing.

While you are nonetheless struggling to rating a loan otherwise would rather to quit credit completely, you can save and buy an automible having cash. It will be the prolonged channel, however, to your together with front, you’ll have zero monthly installments and no expensive rates of interest. You can push 100 % free and you may obvious!